prince william county real estate tax assessment

You can pay a bill without logging in using this screen. Reporting upgrades or improvements.

Prince William County Police Department Home Facebook

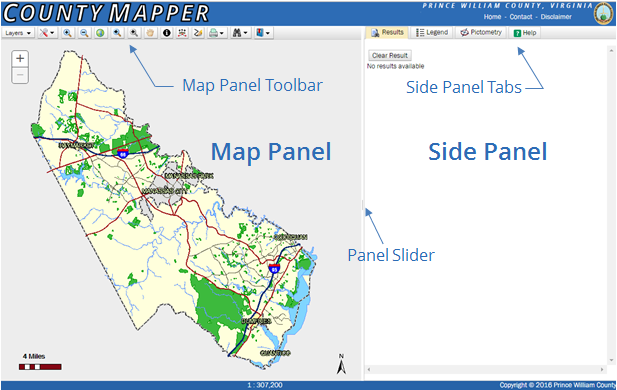

Use both House Number and House Number High fields when searching for range of house numbers Street Name.

. Enter the house or property number. By creating an account you will have access to balance and account information notifications etc. Countywide residential residential real estate increased in value by an average.

Ad Find Out the Market Value of Any Property and Past Sale Prices. Tax Assessor Office Address. Real Estate Assessments is open to the public by appointment only.

Report a New Vehicle. Prince William Tax Assessor. Prince William County - Home Page.

The Prince William County assessors office can help you with many of your property tax related issues including. The property tax calculation in Prince William County is generally based on market value. The Finance Department of Prince William County administers a real estate tax relief program for older adults age 65 and older as well as adults with.

This estimation determines how much youll pay. Enter the Account Number listed on the billing. You will need to create an account or login.

2022 Tax Relief Brochure. When tax assessors estimate the value of your property they multiply that number by the tax rate of the county. 4379 Ridgewood Center Drive Suite 203 Prince William VA 22192.

Report changes for individual accounts. Press 1 to pay Personal Property Tax. Tax Assessor Office Address.

Enter street name without street direction NSEW or suffix StDrAvetc. Prince William County Real Estate Assessor. Real estate Show Real Estate.

4379 Ridgewood Center Drive Suite 203 Prince William VA 22192. Report a Vehicle SoldMovedDisposed. Information on your propertys tax assessment.

The Finance Departments public-facing offices are Taxpayer Services and Real Estate Assessments. The Assessments Office mailed the 2022 assessment notices beginning March 14 2022. Prince William County Real Estate Assessor.

The Prince William County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Prince William County and may establish the amount of tax due on that property based on the fair market value appraisal. Own and occupy the home as hisher sole dwelling. Prince William County collects on average 09 of a propertys assessed fair market value as property tax.

Appealing your property tax appraisal. Face coverings as defined below will be enforced in all County buildings. Included on the real estate tax bills is the special district tax for the gypsy moth abatement program.

1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. Prince William County has one of the highest median property taxes in the United States and is ranked 120th of the 3143 counties in order of median property taxes. Have pen and paper at hand.

Press 2 to pay Real Estate Tax. 9 hours agoMost area residents have seen the value of their property jump under Prince William Countys annual reassessment. In Prince William County Virginia the tax rate is 105 which is substantially above the state average.

Prince William County Real Estate Assessor. All real property in Prince William County except public service properties operating railroads interstate pipelines and public utilities is assessed annually by the Real Estate Assessments Office. 4379 Ridgewood Center Drive Suite 203 Prince William VA 22192.

The County also levies a supplemental real estate tax on newly-constructed improvements completed after the. Prince William County Virginia Home. For additional eligibility criteria please contact the Real Estate Assessments Office at 703-792-6780.

Checking the Prince William County. The real estate tax is paid in two annual installments as shown on the tax calendar. About the Company Prince William County Property Tax Relief For Seniors CuraDebt is an organization that deals with debt relief in Hollywood Florida.

5 days ago Search Prince William County property tax and assessment records including sales search and parcel history by owner name or address. Prince William Tax Assessor. Taxpayer Services is fully operational for walk-in visitors.

This tax is based on property value and is billed on the first-half and second-half tax bills. If you have questions about this site please email the Real Estate Assessments Office. You may view the 2022 assessments via the online Real Estate Property Assessment System.

The average yearly property tax paid by Prince William County residents amounts to about 32 of their. In an effort to mitigate the impact of rising residential real estate assessments the proposed budget is funded at a reduced real estate tax rate of. -- Select Tax Type -- Bank Franchise Business License Business.

Click here to register for an account or here to login if you already have an account. You can contact the Prince William County Assessor for. Enter jurisdiction code 1036.

Report a Change of Address. Market value is the probable amount that the property would sell for if exposed to the market for a reasonable period with informed buyers and sellers acting without undue pressure. The Prince William County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Prince William County Virginia.

How is the Congestion Relief Fee Calculated. Dial 1-888-2PAY TAX 1-888-272-9829.

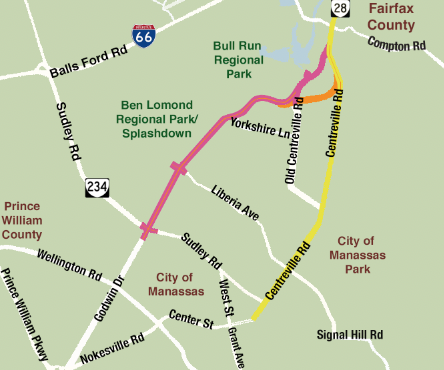

Prince William Area Leaders Call For Reconsideration Of Route 28 Bypass Headlines Insidenova Com

Prince William Wants To Hike Property Taxes Introduces Meals Tax

County Proposed Average Tax Increase Of 250 In Fy2023 Budget Bristow Beat

Now Accepting Applications Restore Retail Grant Program

Prince William County Sheriff S Office Wikiwand

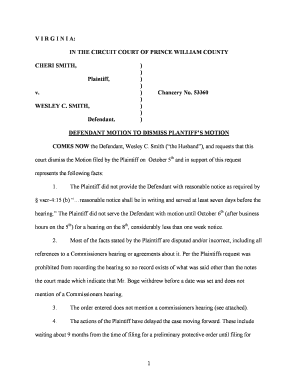

Fillable Online Liamsdad V I R G I N I A In The Circuit Court Of Prince William County Cheri Smith Plaintiff V Liamsdad Fax Email Print Pdffiller

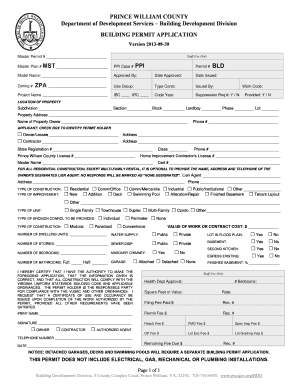

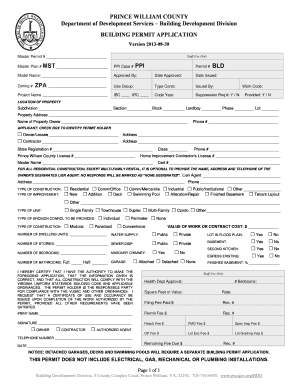

Pwc Building Permit Application Fill Online Printable Fillable Blank Pdffiller

Prince William County Launches A New Show Called County Conversation

The Rural Area In Prince William County

Acting County Executive Proposes The Fiscal Year 2023 Budget Prince William Living

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Data Center Opportunity Zone Overlay District Comprehensive Review

Class Specifications Sorted By Classtitle Ascending Prince William County

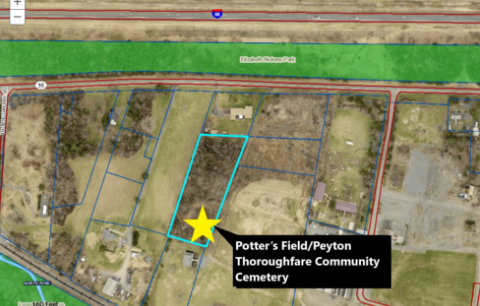

Prince William Board Of County Supervisors Approves Land Purchase In Historic Thoroughfare Community